StrykerFSU wrote:Fair enough Oaks and Wish. Remember, I didn't write the article! If there are statements in it that you can prove to be false, they are not my falsehoods.

Regardless, I'm glad I'm selling my house before the election and may or may not stick the profits under my mattress.

I'd like to know everyone defines as "wealthy" in this day and age? Is $250,000 per year for a household really the "wealthiest Americans"? And before you jump down my throat, I make 10% of that.

Cliff,

While you may not have written the article, you used your words to rephrase someone else's. In doing so you did injected a straw man argument in to the discussion.

A straw man argument is an informal fallacy based on misrepresentation of an opponent's position.[1] To "set up a straw man" or "set up a straw man argument" is to describe a position that superficially resembles an opponent's actual view but is easier to refute, then attribute that position to the opponent (for example, deliberately overstating the opponent's position).[1] A straw man argument can be a successful rhetorical technique (that is, it may succeed in persuading people) but it carries little or no real evidential weight, because the opponent's actual argument has not been refuted.[2]

http://en.wikipedia.org/wiki/Straw_man

Back on topic, I'm not sure household incomes of over 250k should be considered elite. Perhaps individuals making 250k are, but I'm not convinced a family of four making 250k is necessarily elite.

Two of the biggest economic and tax related issues are the executive compensation problem in America, as well as our corporate welfare problem. It unbelievable to see the pace at which executive level salaries have gone up over the last 30 years. You have a system that rewards executives whether they succeed or fail. So what incentive do they have to really do their job well?

http://www.guardian.co.uk/business/2005 ... cutivepay2

"Figures published by the labour federation, the AFL-CIO, show how far the gap has grown. In 1980, a chief executive made $42 for every dollar earned by a blue-collar worker. By 1990, that gap was $85. But the real gains in the boardroom were made in the decade that followed as firms ramped up share options. By 2000, chief executives were earning $531 for every dollar taken home by a typical worker."

For you folks arguing against the raising the capital gains tax, I'll call your bet, and raise you this interesting tidbit, taken from congressional testimony. I'll even use the misnomer of "death tax", instead of the "Paris Hilton tax", to avoid playing semantic games.

"If all corporate welfare were eliminated, the savings would be large enough to entirely eliminate the capital gains tax or the death tax."

http://www.cato.org/testimony/ct-sm063099.html

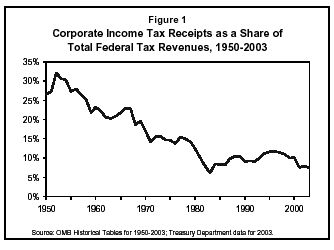

And because it's Friday, here's a graph showing the decline in corporate tax rates, which is really interesting if you contrast this information with the rate at which corporate executive salaries have dramatically increased.

http://www.cbpp.org/10-16-03tax.htm

http://www.cbpp.org/10-16-03tax.htm

"The tax cuts enacted since President Bush took office are typically described as benefiting individuals and not businesses. Businesses are often depicted as sitting on the sidelines, waiting patiently for their turn to have their taxes reduced. The last two tax-cut measures, however, included substantial tax cuts for businesses, including very generous write-offs for investments in plants and purchases of equipment. Under the package enacted in May 2003, businesses can immediately write off 50 percent of the cost of these new investments; businesses with smaller levels of new investments and purchases can immediately write off the full cost of new investments and purchases up to $100,000. These measures will provide businesses with tax breaks totaling more than $175 billion through 2005. Corporations, as distinguished from small businesses, are by far the largest beneficiaries of these tax breaks."

So don't worry folks, Obama isn't coming after

your tax money. He might not grant you another 600 bucks for an imaginary "rebate", but he ain't going to raise taxes on the vast majority of Americans. You can use cute rhetoric like "class warfare" to obsfucate the real debate if you like, but Obama isn't trying to start a class war. He simply believes that the engine of our economy is our middle class, the people that go to work everyday, eat leftover casserole for lunch, and coach youth lacrosse. Ok, so I threw that one in to make myself feel cool.

If you happen to be a corporation, prepare to justify why you should continue to get a free ride, while the income of most normal Americans have remained flat, despite our generous tax subsidies, which really are nothing more than corporate welfare.

If you're a CEO prepare to answer questions about why you deserve a 40 million dollar pay out for running your company in to the ground.

If you're an everyday worker like me, then you'd better get back to work and stop aruging with the internet, because someday your CEO or CIO is going to read this, and stop wondering why your TPS reports are always late.